Understanding Market Dynamics With Dai (DAI) And Trading Signals

February 17, 2025 2:47 pm

understanding of market dynamics with DAI (DAI) and trading signals

The world of cryptocurrencies has undergone extraordinary growth in recent years, many new investors have joined the market. However, browsing the complex landscape of cryptocurrency can be discouraging, especially for beginners. In this article, we will explore two popular digital currencies: Ethereum (ETH), a leader in the industry, and give (DA), a decentralized stablecoin that has obtained significant attention.

Ethereum (ET)

Established in 2015 as an Open-Source platform, Ethereum is one of the most used digital currencies. It is known for its programmable blockchain technology, which allows developers to create smart contracts and decentralized applications (DAPPS). Ethereum’s native cryptocurrency, Ether (ETH), was a reference point for other cryptocurrencies.

DA: a decentralized stablecoin

In 2017, the SUI team announced the launch of DAI, a digital asset that uses advanced mathematical techniques to maintain its value related to the US dollar. DAI is designed as an Open-Source project with a decentralized and built governance model of the Ethereum intelligent contract platform.

Key features:

- Decentralized : Dai operates on a consensus algorithm (POS), which allows more energy efficient transactions.

- Legged : Dai maintains its value related to the American dollar, which makes trading and use for everyday transactions easier.

- decentralized staking : The station process is automated using a decentralized network by validators, ensuring that all users have an equal opportunity to participate.

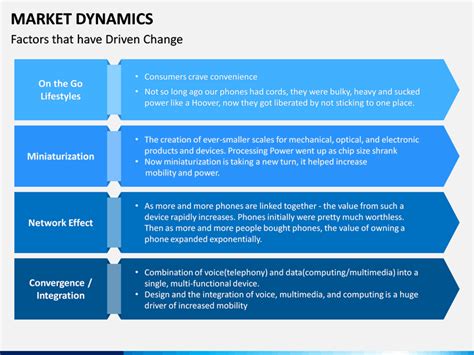

market dynamics

The cryptocurrency market can be volatile, with prices influenced by various factors, such as:

- Offer and request : Changes in the total offer of a cryptocurrency, combined with the request from traders and investors.

- Technical analysis : Diagram models and trends used by technical analysts to predict price movements.

- Fundamental analysis : Economic indicators and news affecting the value of a coin.

Trading signals

To effectively navigate these market dynamics, it is essential to remain informed about the latest trading signals. Here are some key information:

- DA the price range : The current price range A DA (DAI) can be found on online platforms, such as coinmarketcap or cryptoslate.

- Trading volume : Check DAI trading volume to evaluate market interest and potential price movements.

- Technical indicators : Use technical indicators such as mobile environments, relative resistance index (RSI) and Bollinger bands to identify potential tendencies and reversals.

Trading tips

Here are some additional tips for trading DA:

- The average costs in dollars : Invest a fixed amount of money at regular intervals, regardless of the direction of the market.

- Position size : Limit the position size based on risk tolerance and available capital.

- Risk Management : Set stop loss commands to limit potential losses.

- Remain informed : Continuously monitor the market news and technical analysis to make informed trading decisions.

Conclusion

Understanding the dynamics of the market with DAI (DA) and trading signals can help you to navigate the cryptocurrency landscape. By remaining informed about the latest developments, using technical indicators and using risk management strategies, you can increase your chances of success in this rapid evolution. Remember, the transaction of cryptocurrencies involves significant risks; Always do your research, set realistic expectations and never invest more than you can afford to lose.

additional resources

For further learning and guidance on cryptocurrency, consider the following resources:

- Cryptocurrency guides : Web sites such as Coindesk, Coindesk and Cryptoslat offer comprehensive guides and tutorials.

2.

Categorised in: CRYPTOCURRENCY

This post was written by

Comments are closed here.