LP, Digital Asset Management, Crypto Trading

February 7, 2025 5:49 pm

The Future of Finance: Exploring the World of Cryptocurrencies and Digital Assets

In recent years, the world of finance has undergone a significant transformation. The Rise of Cryptocurrencies Like Bitcoin and Ethereum Has Given Birth to a New Class of Assets That Are Changing the Way We Think Of Value, Liquuidity and Safety. In this article, We Will Delve Deeper Into the World of Encryption Loan Platforms (LPS), Digital Asset Management Systems (DAM) and Explore How they are transforming the encryption industry.

Cryptography Laying Platforms (LPS): A New Paradigm for Finance

A Loan Platform is a Type of Investment Product That Allows Users to Lend Their Assets to Others in Exchange for Interest Payments. Crypto-LP Platforms Emerged As A Popular Alternative to Traditional Loan Options, Offering a Number of Benefits and Risks. Here are some important features:

* Decentralized Governance : LPS Operate with blockchain Technology, Allowing Decentralized Governance and Transparency.

* Liquuidity Provision : LPS can provide liquidity to users, providing access to a pool of assets that can be borred or negotiated.

* Risk Management

: When diversifying your portfolios by Various Assets, LPS can reduce risk exposure.

Examples or crypto-lp platforms include:

* aave : A decentralized loan platform that allows users to lend and lend cryptocurrencies such as ether and USD coin (USDC).

* uniswap : a decentralized exchange that allows the negotiation of cryptocurrencies without confidence.

* Compound : a decentralized loan platform that sacrifices a variety of features, including yield agriculture and piles.

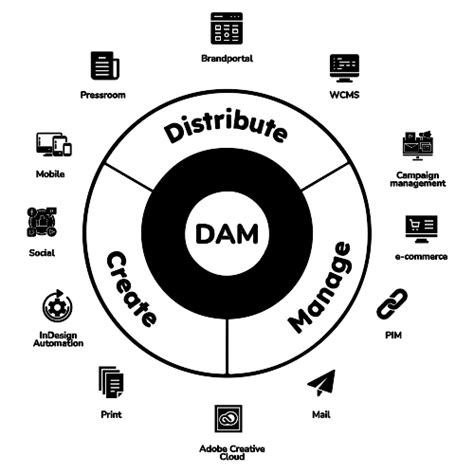

Digital Asset Management (DAM): A Platform for Asset Owners

Dam Systems Are Designed to Help Asset Owners Manage Their Digital Assets, Ensuring that They Remain Safe, Liquid and Compatible with Regulatory Requirements. Here are some important features:

* Asset Pool : Dams Allow Multiple Users to Reweet Their Assets in A Single Portfolio.

* Security : Dams use advanced encryption techniques to protect user assets from unauthorized access.

* Transparency : Many Dam Platforms Offer Real -Time Visibility on Asset Property, Allowing Users to Track Their Partipation.

Examples of Digital Asset Management Systems Include:

* Coinbase Digital Asset Management : A Platform That Allows Users to Manage Their Digital Assets, Including Cryptocurrencies Such As Bitcoin (BTC) and Ethereum (ETH).

* Kraken Digital Assets : A Comprehensive Dam System That Offers Resources Such As Security, Transparency and Auditability.

* Binance Digital Asset Management : A Platform That Allows Users To Buy, Sell and Negotiate Multiple Digital Assets in A Single Interface.

Encryption negotiation: The Future of Markets

Cryptography Trade has Become Increasingly Popular in recent years, with platforms Such as binance and coinbase offering a variety of resources to traders. Here are some -chave aspects:

* Making the market : encryption trade platforms sacrifice market manufacturing services, Allowing users to buy and sell cryptocurrencies at predominant market prices.

* Leverage : Many encryption trade platforms Allow Users to Enjoy Their Positions Using Margin Negotiation.

* Risk Management : Encryption Trade Platforms Usually Provide Risk Management Tools, Including Stopping and Position Sizing Orders.

Examples of encryption trading platforms include:

* Binance : A Popular Platform To Buy, Sell and Negotiate Cryptocurrencies Such As Bitcoin (BTC), Ethereum (ETH) and Altcoins.

* Coinbase : a well -established platform to buy, sell and negotiate multiple digital assets, including cryptocurrencies Such as bitcoin (BTC) and ethereum (Eth).

* Huyo : A comprehensive encryption trade platform that sacrifices resources such margin negotiation, leverage and risk management.

Categorised in: CRYPTOCURRENCY

This post was written by Munna

Comments are closed here.